While searching for an article I wrote a few years ago for the Vancouver Sun on manufactured housing, I came across this article on a US website that addresses some of the differences between different types of manufactured housing and RVs, etc. Since this is so topical, I am printing it below:

Michael Geller, Making a Home for Manufactured Housing, a Vision for America

That same exercise is useful in reverse. It’s helpful to understand what other nations do that may prove to have valuable insights for manufactured and modular home builders here in the U.S.

Geller on Factory Home Building

Architect Michael Geller shared his experiences of the recent 2017 Manufactured Housing Association of British Columbia’s annual conference. Geller’s column in the Vancouver Sun began with the headline, “Making a Home for Manufactured Housing.”

Geller’s thoughts will be explored below, after context is provided.

Let’s note that Geller nailed all of the terminology. MHProNews, and MHLivingNews readers are routinely reminded how useful it is to properly describe our homes, because it elevates the value proposition to all those who are listening or reading.

Snapshot from Canada’s Versions of Factory Building

For those not familiar with Canada’s version of manufactured housing, they have a code known as Z240 that their homes are built to, roughly analogous to the HUD Code for manufactured housing in the U.S.

As in the states, Canadian modular are built to the same standards as conventional housing, which like Z240s, are built in a controlled environment.

Specifically, the Canadian Manufactured Housing Institute (CMHI) says, “Regardless of how or where a building is constructed, the authority having jurisdiction (e.g. the municipality) where the building will be located has a mandate to confirm that the building is built to code requirements. A certification label, indicating compliance with Canadian Standards Association (CSA) standards, is the building inspector’s assurance that the factory-constructed parts of the building meet local requirements.”

Code References to Z240 MH Series Manufactured Homes

“Some building codes state that homes constructed in compliance with Z240 MH Series are “exempt” from the code. In effect, this means that homes constructed to the standard are deemed to comply with the code. Local authorities rely on the Z240 MH label to confirm acceptability.”

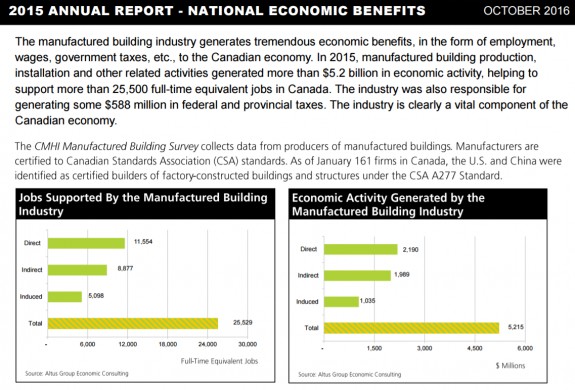

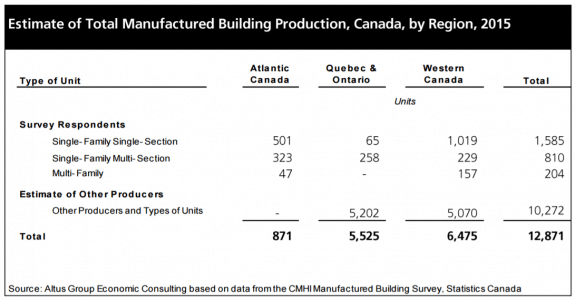

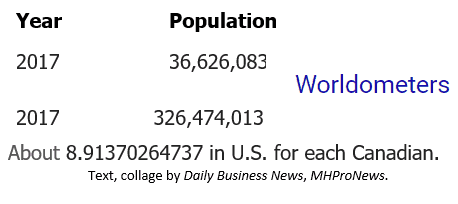

If you look at the statistics in the CMHI statistical reports document, linked here, and adjust for the population difference between the U.S. and Canada, it seems that the Canadians could be doing better than their U.S. counterparts. Their annual report has more data than their U.S. counterparts typically do.

About Geller

Simon Fraser University says that “Michael Geller is an architect, planner, real estate consultant and property developer with four decade’s experience in the public, private, and institutional sectors. His company, The Geller Group is active in real estate consulting and property development. Current activities include land use planning, feasibility studies, and development approvals for a variety of large and small projects around Metro Vancouver.”

As you consider Canadian vs. U.S. shipment totals, bear in mind that Canada’s population is about 11% of that in the U.S. So, to get a comparable, apples to apples sense, multiply their shipments by 8.91 and you’ll see that their shipment totals look to be higher percentage wise than HUD Code manufactured housing is here in the U.S.

With that Backdrop, Highlights from Michael Geller’s Expertise

“Imagine if cars were built like houses,” says Geller.

“I thought about the differences between building cars and houses on a recent tour of a Kelowna manufactured housing factory organized as part of the 2017 Manufactured Housing Association of British Columbia’s annual conference,” he said. “I was invited to offer the perspective of an architect and developer on factory-built housing to an audience comprising manufacturers, dealers, transporters and government officials,”

Geller explained his history, and the interest than – and now – with homes that could be relocated if needed, but typically would stay in their original location once sited.

“I have had a longstanding interest in manufactured housing dating back to 1970 when I was one of seven architectural students from across Canada to win a CMHC travelling scholarship. Our travels took us across the U.S. with guide Warren Chalk, one of the founding members of Archigram, an avant-garde 1960s British architectural group, with projects that included Plug-in-City, a massive framework into which modular dwellings could be slotted and removed.”

Back then, Geller spent weeks learning and promoting the early days of factory built housing.

“For six weeks,” he said, “we toured mobile home parks and housing factories on a government initiative to promote manufactured housing on a major scale.”

As part of his thesis years ago, he proposed concepts he believed would be good for the industry and Canadian society.

“In my university thesis,” said Geller, “I focused on a factory-produced relocatable housing system, and proposed that just as schools set up portable classrooms, governments could install modular housing on vacant lots. This could then be relocated when the property was needed for redevelopment, effectively eliminating the cost of land.”

He gave examples of past projects and plans, then said, “In recent years, BC Housing and the City of Vancouver undertook a feasibility study of a concept to promote relocatable modular housing as an alternative to housing people in shelters.”

In British Columbia (B.C.), “today, thousands of attractive permanent homes are being built in factories. Companies such as Triple M, Moduline, SRI and many other manufacturing plants are constantly improving assembly-line procedures to build complete homes in days, rather than weeks or months,” he says, using points familiar with professionals south of the U.S. Canadian line.

“By building in climate-controlled settings, workers are not dealing with rain or snow,” he said. “Waste is considerably reduced, and consequently factory-built homes are cost-effective, environmentally smart, and able to be customized as on-site construction. For this reason, many of the PNE show homes have been built using modular construction.”

“At the Kelowna conference, I learned there are two basic types of factory-built housing: manufactured homes and modular-built homes.”

What follows would be wonderful if American public officials and media reported as accurately as did Geller.

“Manufactured homes are typically constructed on a steel frame in one or two sections and are virtually complete when they leave the factory. Thus, they are ready for move-in the same day or a few days after arriving on the site. These homes can be installed on simple foundations and even relocated, although most are never moved from their original site,” he wrote.

He notes that the homes can be placed on crawl spaces or over a full basement. Many in the U.S. tend to forget that concrete slab construction can be harder on the body. So the type of building that manufactured and modular homes produces is not only more economical, it can be healthier too.

“Modular-built homes do not have a steel frame,” (Editor’s note to American readers; in the U.S. you can have on-frame as well as off-frame modular building). Geller said, “A typical bungalow consists of one or two modules, while multi-storey homes or buildings are created with multiple modules. These homes are typically set on full-perimeter foundations with a crawl space or even a full basement.”

Geller wraps with surprise, but a prediction for future acceptance and growth.

“While I am surprised that factory-produced housing is not more popular in Canada, expect this to change, since it is cost-effective, energy- and resource-efficient, and well suited to a variety of housing forms. It could be an affordable solution for infill and laneway housing, and multi-storey apartments.”

Imagine if houses were built like cars.”

Indeed. ##

(Image credits are as shown, and when provided by third parties, are shared under fair use guidelines.)